Home and Car Loan: Cure for Inflation Inflation too! RBI will increase repo rate for the fourth time in a row, make loans costlier: Experts

Home and Car Loan: The cure for the merger of inflation is another inflation! Loans who have taken home and car loans are asking the same question to the Reserve Bank. Whatever the common people may argue, but it is believed that the Reserve Bank has prepared to increase the repo rate for the fourth time in a row as a measure to check inflation. Let us tell you that the Reserve Bank is going to review the monetary policy next week.

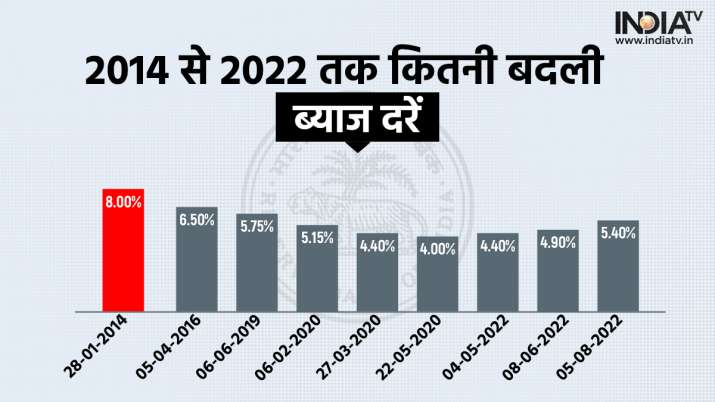

Repo rate has increased by 1.4 percent since May

RBI has increased the repo rate by 1.40 percent since May to control inflation. During this period, the repo rate has increased from 4 percent to 5.40 percent. According to experts, the Monetary Policy Committee (MPC) may decide to increase the repo rate by 0.50 percent on September 30. If this happens, the repo rate will increase to 5.90 percent.

Inflation is not stopping

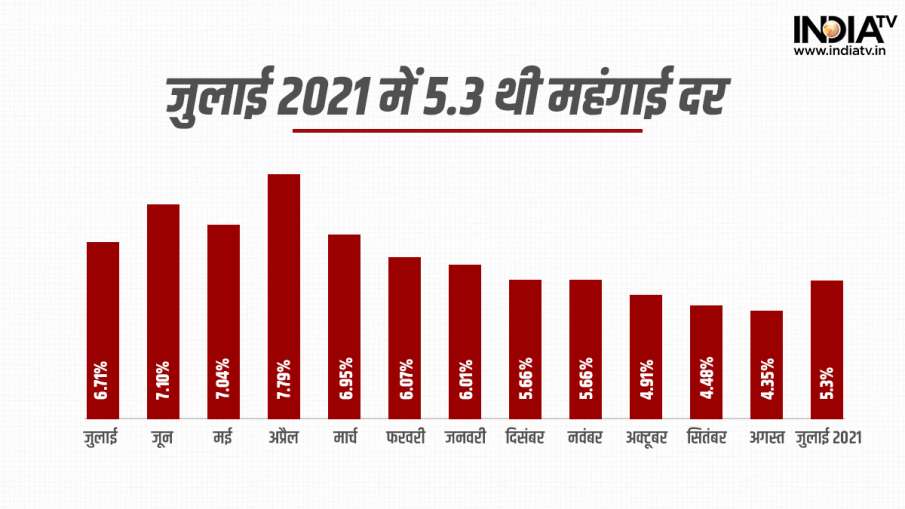

At present, the effect of raising interest rates by the Reserve Bank on inflation is not visible. Retail inflation based on the Consumer Price Index, which started moderating from May, rose to 7 per cent in August. RBI takes into account retail inflation while formulating its biennial monetary policy. The three-day meeting of the Monetary Policy Committee, headed by the RBI Governor, will begin on Wednesday and a decision on rate changes will be given on Friday, September 30.

inflation

What do experts say

Madan Sabnavis, Chief Economist at Bank of Baroda: Inflation is going to remain around 7 percent and in such a situation, rates are bound to increase. An increase in the repo rate from 0.25 to 0.35 per cent means that the RBI is confident that the worst of inflation is over. At the same time, keeping in view the recent developments in the foreign exchange market, the rates can also be increased by 0.50 percent. RBI’s job is to ensure that retail inflation remains at 4 per cent (up or down two per cent).

Dhruv Agarwal, Group CEO, Housing.com: High inflation is a major cause of concern for the RBI and banks will raise interest rates on home loans as a result of the rate hike. However, we believe that it will not have much impact as the demand for the property remains. Rather, the demand is going to increase during festivals. State Bank of India had said in its special report that an increase of 0.50 percent is fixed in the rates. It had said that the highest repo rate would go up to 6.25 per cent and the final hike would be 0.35 per cent in the December policy review.

Latest Business News

function loadFacebookScript(){

!function (f, b, e, v, n, t, s) {

if (f.fbq)

return;

n = f.fbq = function () {

n.callMethod ? n.callMethod.apply(n, arguments) : n.queue.push(arguments);

};

if (!f._fbq)

f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

}(window, document, ‘script’, ‘//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1684841475119151’);

fbq(‘track’, “PageView”);

}

window.addEventListener(‘load’, (event) => {

setTimeout(function(){

loadFacebookScript();

}, 7000);

});

,