Reserve Bank again increased the interest rate

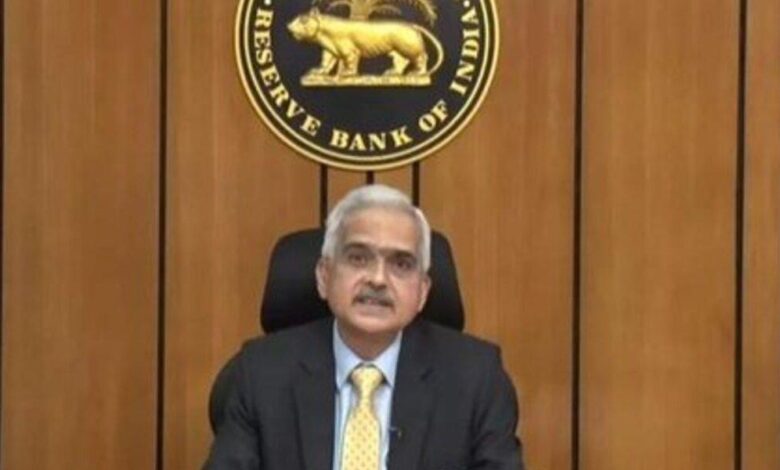

Mumbai The Reserve Bank of India has once again increased the policy interest rate. After the bi-monthly meeting of the Monetary Review Committee, which lasted for three days, RBI Governor Shaktikanta Das announced a half percent increase in the repo rate. The central bank has increased the repo rate for the third time in a row. With the increase in repo rate, taking loans for housing and vehicle will become costlier and the installments of loans already taken will increase. This will have a negative impact on the growth rate. However, the Reserve Bank has kept the growth rate forecast at 7.2 per cent.

Referring to the high inflation rate, the Governor of the Reserve Bank announced a half percent increase in the repo rate. After this hike, the repo rate has increased from 4.9 per cent to 5.4 per cent. This has exceeded the level at the time of the start of the corona virus epidemic. Earlier, RBI had hiked the repo rate by 0.90 per cent twice in May and June. Announcing the increase in the interest rate, Shaktikanta Das said, “We are going through the problem of high inflation and financial markets have also been volatile. Keeping in view the global and domestic scenarios, the Monetary Policy Committee has decided to hike the benchmark rate.

The RBI governor also said that the Monetary Policy Committee has decided to focus on withdrawing the soft policy stance to contain inflation. He said that the International Monetary Fund has lowered the forecast of economic growth and expressed the risk of recession. Shaktikanta Das said that the Reserve Bank of India has kept the economic growth rate forecast for the current financial year at 7.2 percent.

Apart from this, the central bank has also retained the estimate of retail inflation to be 6.7 percent in the current financial year. The RBI governor said the inflation forecast for the fiscal year 2022-23 is retained at 6.7 per cent, based on a normal monsoon and the possibility of crude oil prices at $105 per barrel. However, regarding the Indian rupee, which has reached a record low, the governor said that the rupee is trading in an orderly manner. It has weakened by 4.7 per cent till August 4. He said that the major reason for the fall in the rupee is the strengthening of the dollar and not any weakness in the domestic economy.