The truth of the government! Highest GST rate of 28% will be applicable on these items, slabs may be reduced

GST

Highlights

- GST rate of 28% on luxury products to continue

- Ready to discuss conversion of three other categories of tax into two categories

- Taxes on money form a major part of the revenue of the central and state governments.

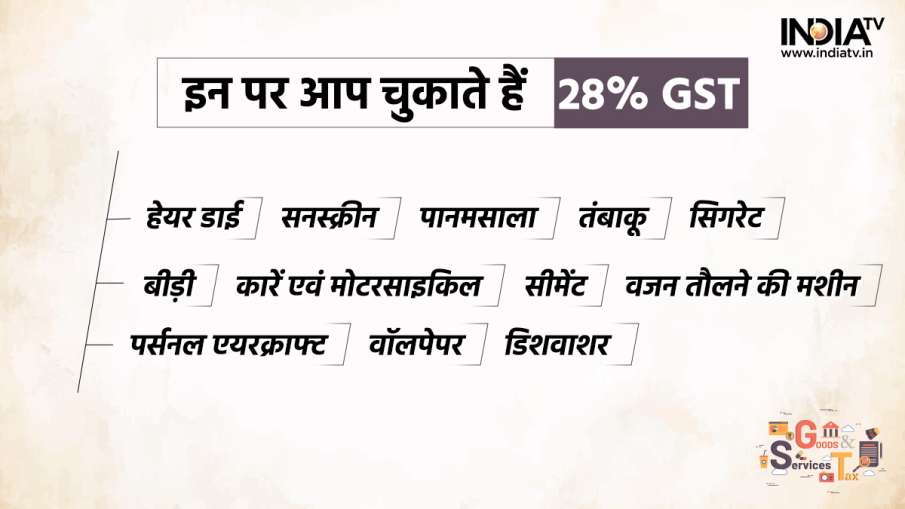

There is a lot of talk about GST these days. In the recent meeting of the GST Council, many items were included in the purview of GST and the slabs of many items changed. But horse racing and casinos still avoided falling in the 28 per cent bracket. Meanwhile, Revenue Secretary Tarun Bajaj clarified that the government intends to retain the 28 per cent GST rate on luxury products.

28% GST

Tax slabs will come down

Bajaj made it clear that the 28 percent rate will remain the same, but he also talked about reducing the rest of the GST slab. He said that the government is ready to discuss the conversion of three other categories of tax into two categories. Bajaj said at an event of industry body Assocham here that the GST Council’s exercise of rationalizing the rates of Goods and Services Tax (GST) is the result of introspection after five years of the tax system. He said the policy-makers are not keen on taking the tax rates down to the revenue-neutral level of 15.5 per cent.

Petrol diesel will come under GST

On the demand for bringing petroleum products under the purview of GST, he said that tax on fuel forms a major part of the revenue of the central and state governments, so there are some apprehensions about it. He said, “We will have to wait for some time.” Bajaj said, “As far as the tax structure of GST is concerned, out of the rates of 5, 12, 18 and 28 per cent, we have retained the rate of 28 per cent. Have to keep In a developing economy with income inequality, there are some luxury products that require higher tax rates.

Will there be only 1 tax rate?

“However, we can adjust the other three tax rates in two rates,” Bajaj said. This way we can see how the country progresses and whether these rates can be brought down to just one rate or not. It is a huge challenge.”

GST Collection

This is how the distribution of goods included in GST happens

There are four rates of tax under the GST system. Of these, essential items are taxed at the lowest rate of five per cent. Whereas luxury goods are taxed at a maximum rate of 28 per cent. Two other rates of this tax are 12 and 18 percent. Apart from this, a special rate of three per cent has been kept for gold, jewelery and gems, while polished diamonds attract GST at the rate of 1.5 per cent.

GST Rates

Preparing for change in rates

The GST Council has constituted a Group of Ministers under the chairmanship of Karnataka Chief Minister Basavaraj Bommai to look into rationalization of tax rates. The GoM has been given an additional time of three months to submit its final report. The Revenue Secretary said that after five years of implementation of the GST system, it is time for a review to see how the GST rate structure has evolved. In the meantime, it should also be considered whether there is a need to cut the number of rates or not. Apart from this, which products should be taxed higher and which products should be kept in the lower slab.

function loadFacebookScript(){

!function (f, b, e, v, n, t, s) {

if (f.fbq)

return;

n = f.fbq = function () {

n.callMethod ? n.callMethod.apply(n, arguments) : n.queue.push(arguments);

};

if (!f._fbq)

f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

}(window, document, ‘script’, ‘//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1684841475119151’);

fbq(‘track’, “PageView”);

}

window.addEventListener(‘load’, (event) => {

setTimeout(function(){

loadFacebookScript();

}, 7000);

});

,