Athiya Shetty and KL Rahul’s romantic style again came to the fore, fans asked – when is the wedding?

Athiya Shetty

Highlights

- Athiya Shetty expresses her love for KL Rahul

- The actress shared her favorite picture on social media

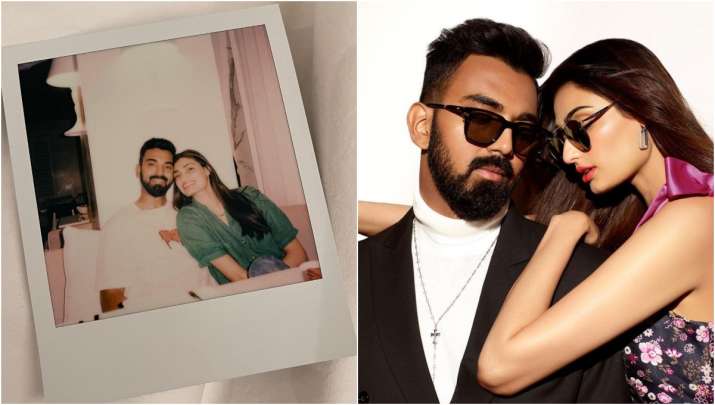

Actress Athiya Shetty and cricketer KL Rahul have been in discussion about their relationship for a long time. The two are often seen together. Not only this, now Athiya and Rahul have started expressing their love for each other openly. The actress is very active on social media and keeps sharing new pictures with her fans every day. Meanwhile, Athiya has made a new post for her fans. Seeing this, the happiness of KL Rahul and his fans knows no bounds.

Athiya and KL Rahul are one of the favorite couples of Bollywood. Fans have been waiting for the marriage of both of them for a long time. However, there were also reports in the past that this couple can announce the wedding date soon. But before the wedding date, a picture has surfaced. Which has been shared by Athiya herself. The actress shared this picture with her boyfriend KL Rahul on her social media account. Which is becoming increasingly viral on social media.

Vikrant Rоna Twitter Review: Kiccha Sudeep’s film made the audience crazy, know the review here before watching

In the shared picture, the couple is seen sitting with each other on a sofa. In the picture, KL Rahul is seen wearing a white T-shirt and trousers, while Athiya is seen wearing a green top and blue denim pants. The fans of both are very much liking this picture. Along with fans, celebs are also commenting on this post. While sharing the photo, Athiya wrote in the caption, “Favorite one.” Also made an emoji of a monkey.

Happy Birthday Dhanush: After making a splash in Hollywood, Dhanush gave this surprise on his birthday

Let us tell you that KL Rahul and Athiya Shetty made their relationship official last year. KL Rahul shared a special post on Athiya’s birthday. After that both were seen together for the first time at the screening of Ahan Shetty’s film Tadap. The family of both also has no objection on their relationship. Recently, KL Rahul went to Germany for his surgery. Where Athiya Shetty was also present with him.

Alia Bhatt breaks silence for the first time on the issue of twins, blames Ranbir Kapoor

Latest Bollywood News

function loadFacebookScript(){

!function (f, b, e, v, n, t, s) {

if (f.fbq)

return;

n = f.fbq = function () {

n.callMethod ? n.callMethod.apply(n, arguments) : n.queue.push(arguments);

};

if (!f._fbq)

f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

}(window, document, ‘script’, ‘//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1684841475119151’);

fbq(‘track’, “PageView”);

}

window.addEventListener(‘load’, (event) => {

setTimeout(function(){

loadFacebookScript();

}, 7000);

});

,