China: The world’s oldest cosmetic powder found here

This proved that the ancient inhabitants of the region were using taxa for 300 years before it became a cosmetic powder for skin whitening.

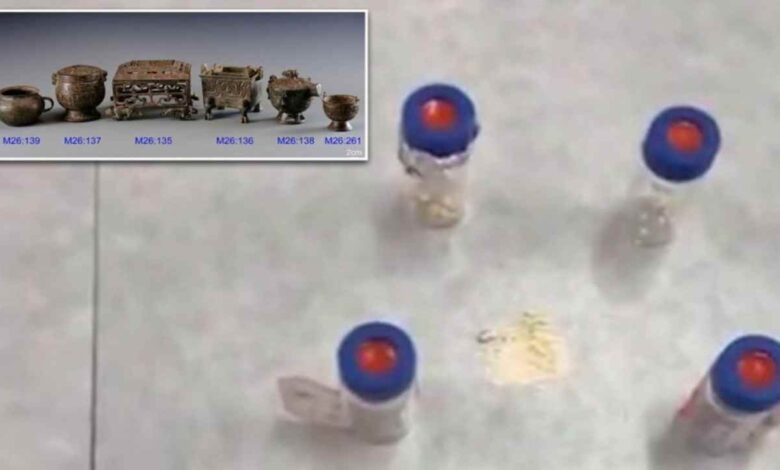

The world’s oldest cosmetic powder has been found in China. Cosmetic powder made of lead has been found from the grave of a person who lived 2700 years ago in China. Six containers made of lead and filled with such cosmetic powder have been found in an ancient tomb of a feudal lord living in the region of northern China. This community settled in the region in spring and autumn from 770 BC to 476 BC. This suggests that the ancient inhabitants of the region were using the powder for the same purpose 300 years before the Romans began using cosmetic powders to whiten the skin.

Let us tell you that experts have long believed that the Romans started the process of whitening simple skin. But evidence in China has forced this belief to change. The area of China where the ancient cosmetic powder has been found was used by the people of that region since 500 BC. Research now says that cosmetic powders first originated in China. Archaeologists of the Chinese Institute of Science are also saying that the cosmetic powder found is not older than the grave. Even in ancient Chinese artifacts, the use of cosmetic powders for skin whitening was considered a high-class hobby.

Powders made from white lead began to be used in Europe in the 1600s

White lead cosmetic powders began to be used in Europe in the 1600s. The practice of making cosmetic powders using toxic lead and vinegar began in Europe. Those who started using those cosmetic powders for religious reasons also had to pay a price on the health front. There have been cases of skin damage, poisoning or even death after using cosmetic powders made from toxic lead and vinegar.

(function (d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id))

return;

js = d.createElement(s);

js.id = id;

js.src=”https://connect.facebook.net/en_GB/sdk.js#xfbml=1&version=v3.2″;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));