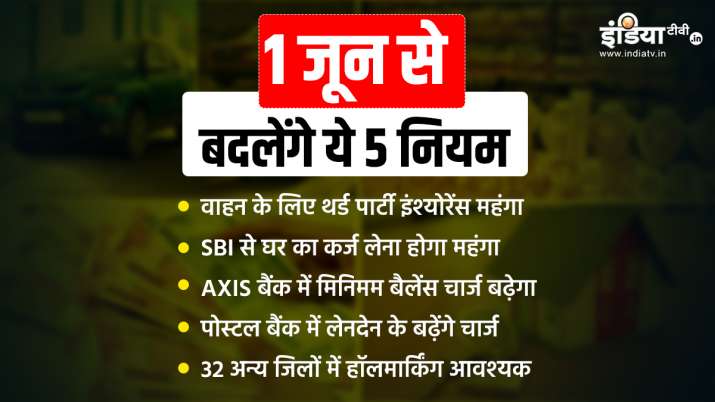

New ‘sting’ of inflation will sting from June 1, these 5 changes will have a big impact on your pocket

1st june

Highlights

- Third party insurance for vehicle expensive

- Taking home loan from SBI will be expensive

- Minimum balance charge will increase in Axis Bank

You must have got relief regarding the prices of petrol and diesel in the month of May, but the month of June is now going to scorch you with the new heat of inflation. With the beginning of the month, on June 1, many changes are going to happen related to your pocket. In such a situation, before the start of the month, it is important that you get ready by tightening your waist. Here we are going to introduce you to 5 such changes that may loosen your pocket in June.

You will have to pay more money for third party insurance

If your vehicle insurance is due in June, then you are bound to be hit by inflation in the first month itself. Third party insurance for two wheelers and four wheelers is going to be expensive from the first of June. Explain that under the Motor Vehicle Act, third party insurance is necessary for all vehicles. Comprehensive and zero debt insurance also includes a third party insurance component. For two wheelers, the premium will be Rs 1,366 for vehicles in the range of 150 cc to 350 cc. At the same time, the premium for vehicles above 350 cc will be Rs 2,804.

SBI home loan installments will increase

If you have taken a home loan from State Bank of India (SBI) for your home, then there is bad news for you. SBI has increased the External Benchmark Lending Rate (EBLR) by 40 basis points to 7.05%. Whereas RLLR will be 6.65% plus Credit Risk Premium (CRP). The increased interest rates will be effective from June 1. Earlier the EBLR was 6.65%, while the repo-linked lending rate (RLLR) was 6.25%.

Expensive to keep money in Axis Bank

Keeping money in Axis Bank, a private sector bank in the country, will now become expensive. Axis Bank has increased the service charge on the savings account. From June 1, the limit for maintaining the minimum balance in the savings account will be increased. Now customers in semi-urban and rural areas will have to keep a minimum of Rs 25,000 instead of Rs 15,000 in all types of savings accounts of Axis Bank. If you keep a term deposit of Rs 1 lakh, then you will get this exemption.

Postal bank will charge

New changes are also happening in India Post Payments Bank (IPPB) of the post office from June. IPPB is going to collect cash transaction fees from June 15. Under the new rules, there will be no charge for the first three cash withdrawals, cash deposits and mini statement taking every month. Thereafter, each cash withdrawal or cash deposit will attract Rs 20 plus GST, while a mini statement transaction will attract Rs 5 plus GST.

The scope of gold hallmarking will increase

From June, the scope of hallmarking of gold is going to increase. Hallmarking centers will also be opened in 32 new districts. Till now, this system was in place in 256 old districts. Now hallmarking of gold ornaments will become mandatory in 288 districts. Now only 14, 18, 20, 22, 23 and 24-carat jewelry can be sold in these districts. These will also be able to sell only after hallmarking.

function loadFacebookScript(){

!function (f, b, e, v, n, t, s) {

if (f.fbq)

return;

n = f.fbq = function () {

n.callMethod ? n.callMethod.apply(n, arguments) : n.queue.push(arguments);

};

if (!f._fbq)

f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

}(window, document, ‘script’, ‘//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1684841475119151’);

fbq(‘track’, “PageView”);

}

window.addEventListener(‘load’, (event) => {

setTimeout(function(){

loadFacebookScript();

}, 7000);

});

,