In this country, inflation has hit so hard that banks have been ordered not to give loans to anyone.

This country is facing severe economic crisis

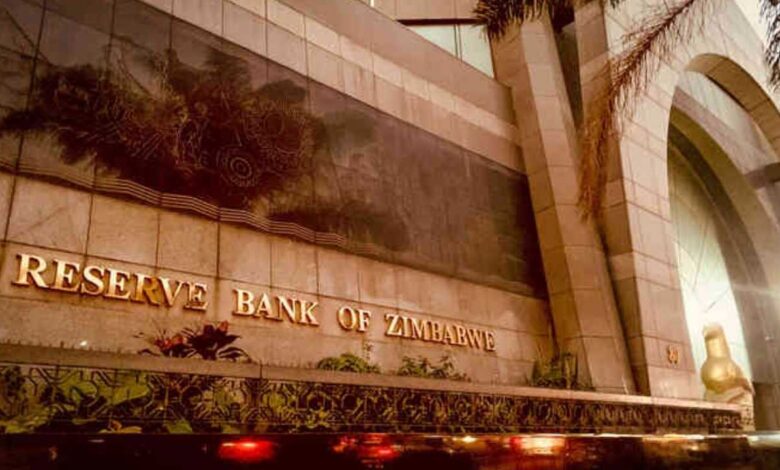

The economic condition of Zimbabwe is very bad. In this country which was facing inflation of 750 percent at one time, the current inflation is still very high. Here the inflation rate in March was 96.4 percent. In such a situation, it is feared that the decision taken by the local central bank in the name of providing relief to the suffering people will further affect the economy and will put more burden on the people.

Let us inform you that the Reserve Bank of Zimbabwe has stopped lending by any bank or financial institution to any government or private business or person with immediate effect. Apart from this, banks will not have to give loans from now on. Also, for those for whom the loan has been announced now, a case-based decision will be taken.

Let us tell you that on 7 May, President ED Mangagwa announced that various economic measures will be taken to stabilize the country’s economy and earn the confidence of the local people. Accordingly, this announcement has been made. So now the question is, how will the economy work? If the move prevents the country from getting overdrafts for business, term loans for fresh investments or personal loans for purchases.

This step is taken only when there is evidence that banks are printing money, they are buying this printed money and inflation is increasing due to the purchase. What will be the impact of this decision of the central bank, only time will tell whether inflation will fall or the economy will fall into recession.

(function (d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id))

return;

js = d.createElement(s);

js.id = id;

js.src=”https://connect.facebook.net/en_GB/sdk.js#xfbml=1&version=v3.2″;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));