Expanding on the positive pattern in April, valuable metals shut on a solid note in May. The shortcoming in the U.S. dollar and expansion concerns helped Comex gold close almost a 5-month high on May 28.

Comex gold acquired 7.8% in May to close at $1,905.3 an ounce. Comex silver, as well, shut on a positive note, timing an addition of 8.3% to settle at $28.02 an ounce.

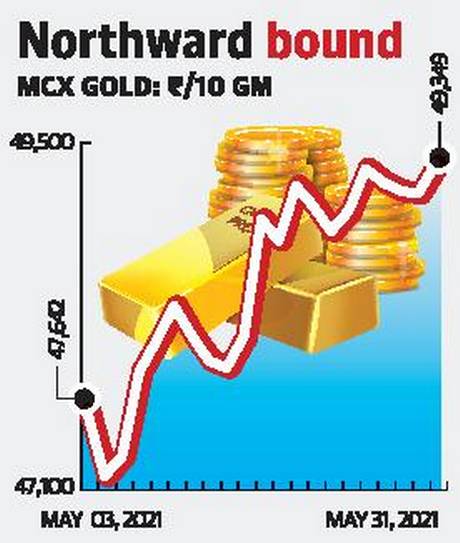

Reflecting the worldwide pattern, MCX gold fates acquired 4.9% to close at ₹49,349 per 10-gm. MCX silver fates acquired 5.2% to settle at ₹71,898 per kg.

Comex gold cost moved well past the objective of $1,865-1,880 referenced a month ago.

The cost could be kept to an exchanging range as the new meeting has driven the cost into a present moment, overbought locale. A move past $1,925 would show that the transition to $1,950-1,960 is in progress.

Until this occurs, expect range-bound or quelled activity in the close to term.

Silver hits target

Comex silver, as well, accomplished the objective of $27.7-28.5 referenced a month ago. Silver costs are likewise prone to be stay stifled and limited to a reach in the close to term.

A move past $29.1 would show that the white metal is gone to the following objective of $30.2-31. Until the breakout occurs, the cost is probably going to be curbed. MCX gold administered firm in May and furthermore moved to the then-referenced objective of ₹48,500-49,500. The present moment is positive and an ascent to ₹51,500-52,000 shows up likely. This view would be negated if the value closes underneath ₹47,200.

MCX silver arrived at the objective at ₹71,500-72,000 demonstrated prior. The transient standpoint is positive and MCX silver could go to the following objective of ₹76,700-77,000. This view would be refuted if the value falls beneath ₹69,100.

To sum up, the medium-term viewpoint for valuable metals stays positive.

While there is a chance of either a momentary union or a minor cool-off, the medium-term upturn is probably going to reassert itself once the expected cool-off occurs.