Explainer: Petrol can be cheaper by Rs 20, know how the complete math of tax will change as soon as it is included in GST

Petrol Diesel

Highlights

- The GST Council can discuss bringing petrol and diesel under GST in a two-day meeting.

- Bringing petrol and diesel under GST will cost the Center and the state a loss of 4.10 lakh crores.

- Option of surcharge in addition to 28% GST to compensate

Imagine that the price of petrol in the country suddenly drops by Rs 20 on Wednesday. You started getting petrol for Rs 76 for Rs 96. Don’t be surprised, this is possible if petrol and diesel are brought under the ambit of GST by the government. An important meeting of the GST Council, the apex body of the Goods and Services Tax (GST) in the country, has started in Chandigarh from Tuesday, June 28. In this two-day meeting, the council can discuss changes in GST rates.

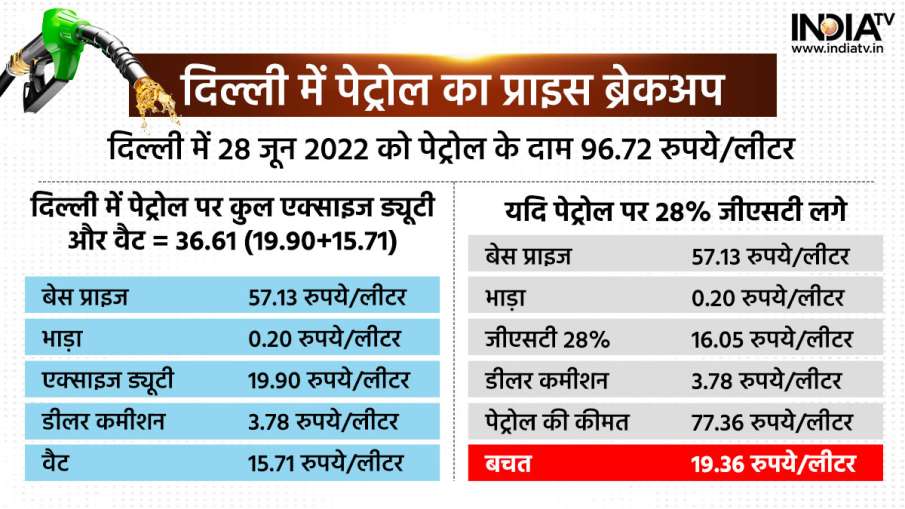

But the most discussed in the council is about petrol and diesel. From the general public to the economists, who are crying about the prices, they are demanding the inclusion of petrol and diesel in the GST. If this happens, then in Delhi, where the public is currently paying excise duty and VAT of Rs 36.61 on petrol, it can come down to Rs 16, that is, the silver of the customers. But if the experts are to be believed, like many council meetings in the past, this time too there is little possibility of discussion on this petrol and diesel.

Let us first read the statements of the policy makers regarding GST.

Before the meeting of the GST Council, the chairman of the Economic Advisory Council to the PM, Vivek Debroy, has expressed the possibility of including petrol and diesel in the purview of GST. He has advocated that if petrol and diesel are brought under the ambit of GST, it will be possible to curb rising inflation.

On bringing petrol and diesel under GST, BJP MP Sushil Modi has said that it will collectively cause an annual loss of 2 lakh crores to the states.

Petroleum Minister Hardeep Singh Puri says that the central government will be happy if petrol and diesel are brought under the ambit of GST. But the states don’t want to do that.

If petrol is included in GST?

Petrol Price Breakup

Tax on petrol – how beneficial for the center-state?

It is important to know that what is the share of the price of petrol and diesel in the pockets of the central and state government. On June 28, 2022, the price of petrol of Indian Oil in the capital Delhi is Rs 96.72 per liter. To this, excise duty of Rs 19.90 per liter and VAT of Rs 15.71 per liter was added. This includes dealer commission of Rs 3.78 per litre. Talking about the figures, the government earns about 4 lakh crores every year from petrol and diesel.

How will the schemes be completed if tax is not received

According to an estimate, 10-11 thousand crore liters of diesel is sold annually in India and about 14 thousand crore liters of diesel-petrol is sold by adding 3-4 thousand crore liters of petrol. Bringing petrol and diesel under the purview of GST will result in a loss of 4.10 lakh crore to the Center and the state. It will be difficult to make up for this loss. The central government still needs free corona vaccination, free ration and a lot of money to bring the deteriorating economy back on track. In such a situation, these plans may get stuck.

GST Collection

These two options are there to compensate for the loss

- To compensate for this earning, in addition to 28% GST, surcharge should be levied. The central government also levies surcharge on luxury cars. So the prices will be higher than expected.

- Even after GST, the central government should impose excise duty and the income from it should be divided between the central and state government. For this both the governments will have to agree on this formula.

function loadFacebookScript(){

!function (f, b, e, v, n, t, s) {

if (f.fbq)

return;

n = f.fbq = function () {

n.callMethod ? n.callMethod.apply(n, arguments) : n.queue.push(arguments);

};

if (!f._fbq)

f._fbq = n;

n.push = n;

n.loaded = !0;

n.version = ‘2.0’;

n.queue = [];

t = b.createElement(e);

t.async = !0;

t.src = v;

s = b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t, s);

}(window, document, ‘script’, ‘//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1684841475119151’);

fbq(‘track’, “PageView”);

}

window.addEventListener(‘load’, (event) => {

setTimeout(function(){

loadFacebookScript();

}, 7000);

});

,